Letters to the Editor

Letter to the Editor | Olympia is coming for your money

I’ve already written about Olympia’s efforts to raise the 1% limit on property tax increases each year, but that’s just the tip of the iceberg. Olympia is coming after your money in many different ways and in huge amounts. This is just a brief summary of what our legislators are discussing when it comes to your wallets.

School bonds (SB5186)

There are both constitutional and statutory limits on the amount of bonds a School District can issue for “capital purposes.” Currently, these limits can be exceeded, but only with the approval from 60% of the voters in the School District provided at least 40% of the registered voters actually vote. SB5186 would lower the 60% requirement to a simple majority or 50+%. It also removes the requirement that at least 40% of the registered voters must actually vote. If the turnout is only 20% and 50% of that 20% or 10% of the total registered voters plus one votes for the bonds, they pass.

Gasoline taxes (SB5726)

Under existing law, a Washington gas tax of $0.0494/gallon is charged every time someone fills up their tank. Almost every government entity has been encouraging people to buy hybrid and electric vehicles. Many have responded to that encouragement. Now, the state is complaining that its revenue from the gas tax is declining so it wants to shift from a gas tax to a “Road Usage Charge” to be imposed on each mile driven. How much? $0.026 per mile. 12,000 miles is a $312.00 charge. People would self-report their mileage. What could go wrong with that? How rewarding is this for those who responded to the government’s encouragement to go electric?

Miscellaneous increases

| Subject | Bill # | Comments |

| AirBNB | SB5576 | Imposes a new 6% sales tax on AirBNB rentals making them more expensive to renters |

| Hunting & Fishing | SB5583 | Imposes a 50% (!!) increase in one day use fees |

| Local Sales Taxes | SB5775 | Allows local governments to impose increases in sales taxes for “public safety” WITHOUT voter approval (how big of an umbrella is “public safety?”) |

| Cellphone Fees | SB5762 | Doubles (!!) the current 40₵ per line to 80₵ |

| Estate Taxes | HB2019 | Increases Washington’s estate tax rates which, if signed into law, would make Washington’s estate tax rates the highest in the nation. |

The sales and gas taxes are two of the most regressive taxes out there. The word “regressive” means those in the lower income brackets will feel the impact of the tax more heavily than those in the upper income brackets. So much for protecting the average citizen!

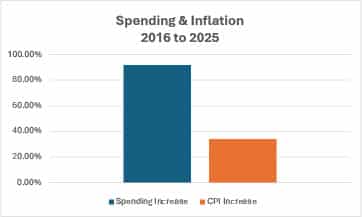

Is inflation causing spending increases?

Proponents of all these bills say that inflation is straining the state budget. Let’s take a look at the rate of increase in spending and the inflation rate over the past few years. See the Spending & Inflation 2016-2025, below. This chart shows Washington’s increase in spending since 2016, and it also shows the CPI increase for Washington over the same time period. As you can clearly see, inflation has had absolutely no impact on Olympia’s spending. Since 2016, state spending has almost doubled while inflation is up just slightly over 30%.

The expected 2025 budget deficit was projected to be around $10B when Inslee was still in office. The expected budget deficit is now expected to grow to $13B or more (no one really knows) over the next four years.

State office holders may get significant raises

In addition to the many tax and fee increases, you might be interested in hearing about pay raises for the people who want more of our money. There is a proposal from a citizens’ panel that would provide significant pay raises for the same people who’ve spent us into this financial mess. See Proposed Salary Increases below. Inflation seems to be working for them, but its certainly working against the taxpayers!

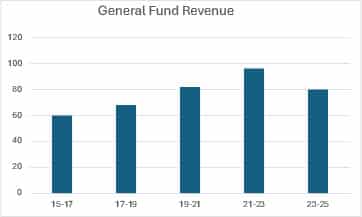

General fund revenue from 2015 to 2023

General Fund Revenues have also grown substantially since 2015 as the chart below shows. The expected decrease in revenues for the current two year biennium is due mainly to the following factors:

- The largest factor is a decrease in sales taxes

- A decrease in B&O (Business and Occupation) taxes (a tax on the gross receipts of a business or occupation)

- A decrease in exports due mainly to the Boeing strike

- Fewer housing permits than in previous years

- A decrease in vehicle license fees

- A decrease in interest income (deficit spending drains cash accounts)

- A decrease in interest income (deficit spending drains cash accounts)

Craig McLaughlin

Fox Island