Letters to the Editor

Letter to the editor: Does PenMet really handle funds responsibly?

In response to Ed Friedrich’s well-researched article on PenMet’s Levy Lid Lift proposition:

The 2.5% assumed assessed value increase

With regard to the 2.5% assumed increase in assessed values, Mr. Friedrich quotes the County Assessor as saying the 2.5% is a reasonable estimate. I don’t argue that point. My point is that PenMet, being a taxpayer-supported entity with more than 80% of its revenue coming from property taxes, should willingly let the voters know the maximum amount PenMet may take from the taxpayers because of this levy lid lift. I asked Ally Bujacich what the maximum additional levies could be, and she responded by saying “$24 million.” PenMet knows the maximum number so why don’t they inform the voters?

For committee says PenMet handles funds responsibly

(Three examples: this is not my opinion.)

2021 termination of the Park Host Program

The Park Host program provided onsite management through the park hosts who lived onsite. It also provided timely park openings and closings, frequent inspections of the parks, an onsite deterrence to bad behavior, and even some maintenance labor when the hosts voluntarily performed some minor maintenance repairs themselves. That program cost PenMet approximately $12,000 annually, mostly for internet and cable access for the hosts.

Now, PenMet is requiring its highly skilled maintenance staff to open and close the parks. The maintenance person assigned to that task works a full 8 hour day and then comes in early or comes back late to do the openings and closings — at overtime rates. The Teamsters Union estimated that PenMet is spending approximately $60,000 annually in overtime to open and close parks.

Maintenance is not given the time to do anything other than open and close the parks, since the person doing that task has several parks to visit and can’t be in more than one place at a time. They don’t have time to inspect the parks, and they don’t have time to perform any maintenance. The person assigned this task also gets delayed if people are in the park. Closing can’t occur until everyone leaves. PenMet is spending five times what it was spending with the Park Host program and getting far less in return. Does this sound like responsible management?

Paying for former employee silence

PenMet has a practice of asking departing employees to sign a set of documents. In that set, it has been PenMet’s practice to pay those employees monies to which they are not otherwise entitled. It could be labeled as severance pay, additional vacation pay, or something else. Why would they do this? Those documents often times (on every one I’ve seen) contain a promise by the employee not to say anything disparaging against PenMet. Why would PenMet pay these employees to keep quiet? What is PenMet afraid they might say? Is this a responsible way for PenMet to spend its (actually “our”) property tax dollars?

Failed state audit

PenMet failed its last state audit for 2019 and 2020. Here are the comments by the state auditor:

• “…internal controls were inadequate for ensuring accurate financial reporting”

• “…internal control deficiencies that represent a material weakness…”

• “2019 and 2020…liabilities of $642,956 and $768,740…were omitted from the notes and the Schedule of Liabilities”

• “2020 Capital Projects funds transfer in and transfers out were each overstated by $658,034”

How can we trust an entity with, potentially, $24 million more of our money with these accounting weaknesses? What concerns me is the fact that PenMet’s 2023 Budget appears to also have some accounting issues: The interfund transfers (referring to bookkeeping transfers from one account to another) should always total $0. To explain this, if you had a checking account and a savings account at the same bank and you transferred $1,000 from checking to savings, the total amount of cash you have in the bank is exactly the same. One account went down by $1,000 and the other increased by $1,000. Pretty simple. In PenMet’s 2023 budget, its transfers in and out are off by $754,097! I asked for a clarification of this discrepancy and was told the $754,097 was accounted for in 2022. That answer make no sense to me unless PenMet’s 2022 books are also incorrect.

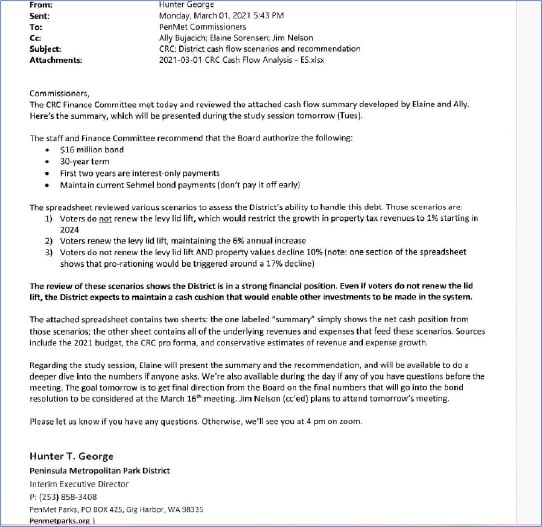

Hunter George’s study

I agree that things could have changed since 2021, when Hunter George did his study. I asked the Board if that’s the case would they explain exactly what’s changed? No response. Mr. Friedrich mentions Zemorah Murray who said the study is “outdated and no longer relevant.” This is a classic PenMet response. How is it outdated? Why is it no longer relevant? Hunter George didn’t remember the study, but here’s his actual email:

Steve Nixon promised me that PenMet would disclose everything the voters need to know before they vote. I think this study should be disclosed to the voters. Don’t you?

Craig McLaughlin

Fox Island