Business Community

Gig Harbor Real Estate | Where have the homes gone?

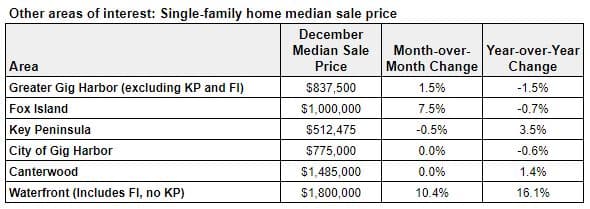

After bottoming out in September 2023 at $827,792, the median price for a single-family home between the Purdy and Narrows bridges rose for the third consecutive month to $850,000 in December, an increase of 2.7%. Prices are now just 1.9% below their peak of $866,835 in October 2022.

Spurring the increase in prices is a historically low number of homes for sale, coupled with demand that has steadily increased over the past eight weeks due to a meaningful decline in mortgage interest rates.

For buyers, there are few options

In December, only 64 single-family homes were for sale between the bridges. Of those, 19 were new to the market during the month — the fewest new listings of any month ever. Outside of the COVID years of 2020-2021, we normally have more than 200 single-family homes available, with an average of 40 new listings in December.

The shortage of homes and increased demand pushed the months of supply — the number of months it would take to sell out of all available homes at today’s sales pace — to just 1.3 months. Looking deeper, this disproportionately impacts more affordable homes. For homes priced at or below the median sale price, there is just 0.6 months of inventory compared to 2.1 months of inventory for those priced above the median sale price of $850,000.

Buyer behavior is changing

Pending home sales volume typically hits its lowest volume in December and jumps in January. This December was different. In December 2023, 30 sales were pending, up 15% from November.

While it is not uncommon to see 30 homes go pending in December, what is remarkable is that 30 homes went pending when there was so little to pick from. This points to a change in buyer behavior.

Buyers have spent countless months on the sidelines waiting for mortgage rates to go down, with many of them also hoping home prices will come crashing down, too. Now that mortgage rates have come down but prices have started to trend up again, they are moving quickly to get back into the market and, in some cases, buying a home that fits most of their needs for fear of being priced out by the time the one they really want comes on the market. Other buyers are getting in now, hoping to avoid bidding wars that may come back as we head into the spring buying season due to the supply and demand imbalance.

A home that sold in 2023 by Hailee Keeley of PropertiesNW.

Looking ahead

In the coming months, I predict more of the same. The majority of sellers who are selling now are doing so because they have to, not because they want to, and therefore, we will have continued low levels of inventory. The best homes in each price range will go fast and for top dollar. Homes that need a lot of work will linger a bit longer because buyer interest is tempered due to elevated mortgage rates that have left buyers with less monthly disposable income for updates and repairs. Given the supply and demand dynamics and the current three-month trend of home price appreciation, the median home price will likely continue to creep up as well.