Business Community

Gig Harbor Real Estate | Prices, inventory are up … but the latter could change with falling interest rates

The greater Gig Harbor area between the Purdy and Narrows Bridges, including Fox Island, saw an increase in both home prices and inventory in July, according to recent data from the Northwest Multiple Listing Service (NWMLS). The median home price for a single-family home reached $891,000 in July, marking a 0.7% increase from June and a 6.7% rise from July 2023. Should home prices continue to rise at the same annual rate, the median home price should be close to $950,000 by July 2025.

As we move past the peak of the summer buying and selling season, we should expect new listings and pending sales to decrease as we approach the end of summer, with families settling in for the upcoming school year. So far, the data indicates that this trend is on track. However, the recent significant dip in mortgage rates may alter this pattern.

Seasonal change ahead

In July, there were 96 new listings of single-family homes and condos for sale in the greater Gig Harbor area, down 15% from the month prior. Pending sales are still on their way up, up 14.9% from June to July, and are expected to fall seasonally in August.

A Wollochet Bay west-facing, low bank waterfront home is listed for $2,750,000 by Carly Bloecher, real estate broker with Properties NW of Gig Harbor.

The month also saw a 6.9% increase in housing inventory, which slightly shifted the market in favor of buyers, giving them a bit more leverage. However, the market is very specific to individual houses. Half of the homes that went under contract in July were on the market for 8 days or less, while the other half took longer to sell. For the homes that sold quickly (within about a week), buyers probably didn’t have much leverage.

Looking ahead to August and September, if history repeats, the housing market will begin its first steps into the winter slumber with fewer buyers and sellers. There will be fewer fresh listings, and homes should linger on the market longer.

Interest rates and mortgage payments

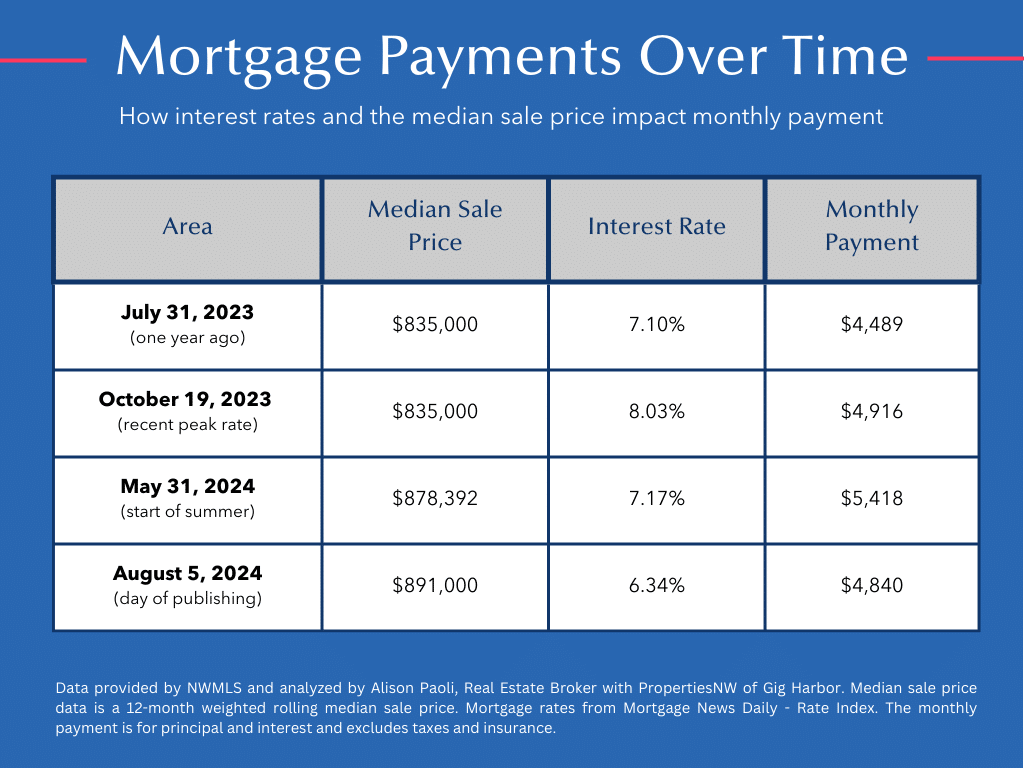

However, it is possible that we will have an encore push of buyers in August and September due to the recent significant decline in mortgage rates that started in mid-July and accelerated in late July. To understand how significant of a decline the rate drop was and why it may bring people back to the market, we can compare the monthly payment of the median Gig Harbor area over several points in time (see image below).

One year ago, in October 2023, when mortgage rates peaked, the median home price was the same, but the interest rate was dramatically different, resulting in a monthly payment difference of $427. More recently, from the beginning of the summer until now, while the median home price has increased by 1.4%, the monthly payment has come down $578.

According to a survey conducted by John Burns Research and Consulting, a research and consulting firm that focuses on the housing industry, an interest rate of 5.5% was the “magic mortgage rate,” or the mortgage interest rate homeowners and renters deemed was the highest acceptable rate for a new home purchase. As we get closer and closer to the magic rate, buyers should expect more competition, which will likely lead to lower inventory and higher home prices.

Shopping for mortgages

If you are thinking about buying a home, watch the market closely and do not forget to shop around for a mortgage just like you would any other big-ticket item – yes, mortgage rates are different everywhere, especially when you look across lending institutions. For example, one boutique lender I spoke with today, Seth Raddue, CEO of Tristar Finance, said that they are quoting buyers below 6% right now for a 30-year fixed conventional loan while major credit union BECU is quoting 6.125%, major non-bank lender Rocket Mortgage is quoting 6.725% and Bank of America is quoting 6.25%.

Alison Paoli