Business Community

Gig Harbor Real Estate | Prices inch closer to record levels

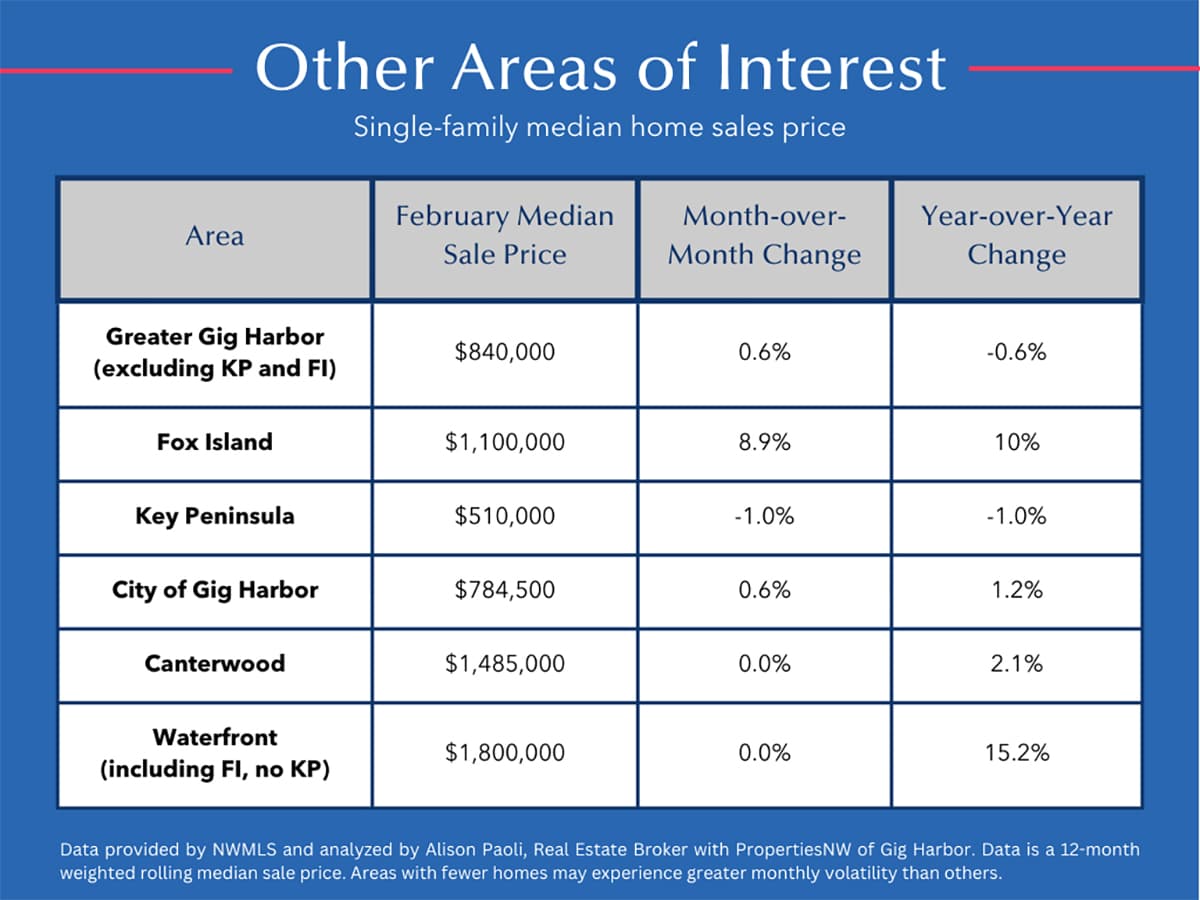

In Gig Harbor, the median home price inched closer to historic highs in February, rising by 0.4 percent from January to reach $853,500 for a single-family home. According to Northwest Multiple Listing Service data, the median price is now less than 1% away from the peak for single-family homes between the Purdy and Narrows bridges, including Fox Island.

The local housing market reached its zenith in October 2022 at $866,835, driven by low interest rates, increased demand and a shrinking inventory. However, after a typical seasonal sales slumber followed by an extreme spike in interest rates, the median home price experienced a 4.5 percent decline by September 2023.

However, the pendulum has swung once more. The median home price rebounded at a swifter pace than its decline and now stands a mere 0.8 percent below the peak. Should this pace continue, we’ll surpass the peak by the time rhododendrons are in full bloom this spring.

Buyers get some good news

While the sweet melody of rising prices brings joy to potential sellers, there’s also encouraging news for buyers. Housing inventory is on the upswing. Though the availability of single-family homes still falls short of historical standards, February witnessed a 20 percent increase in homes on the market compared to the same month in 2023.

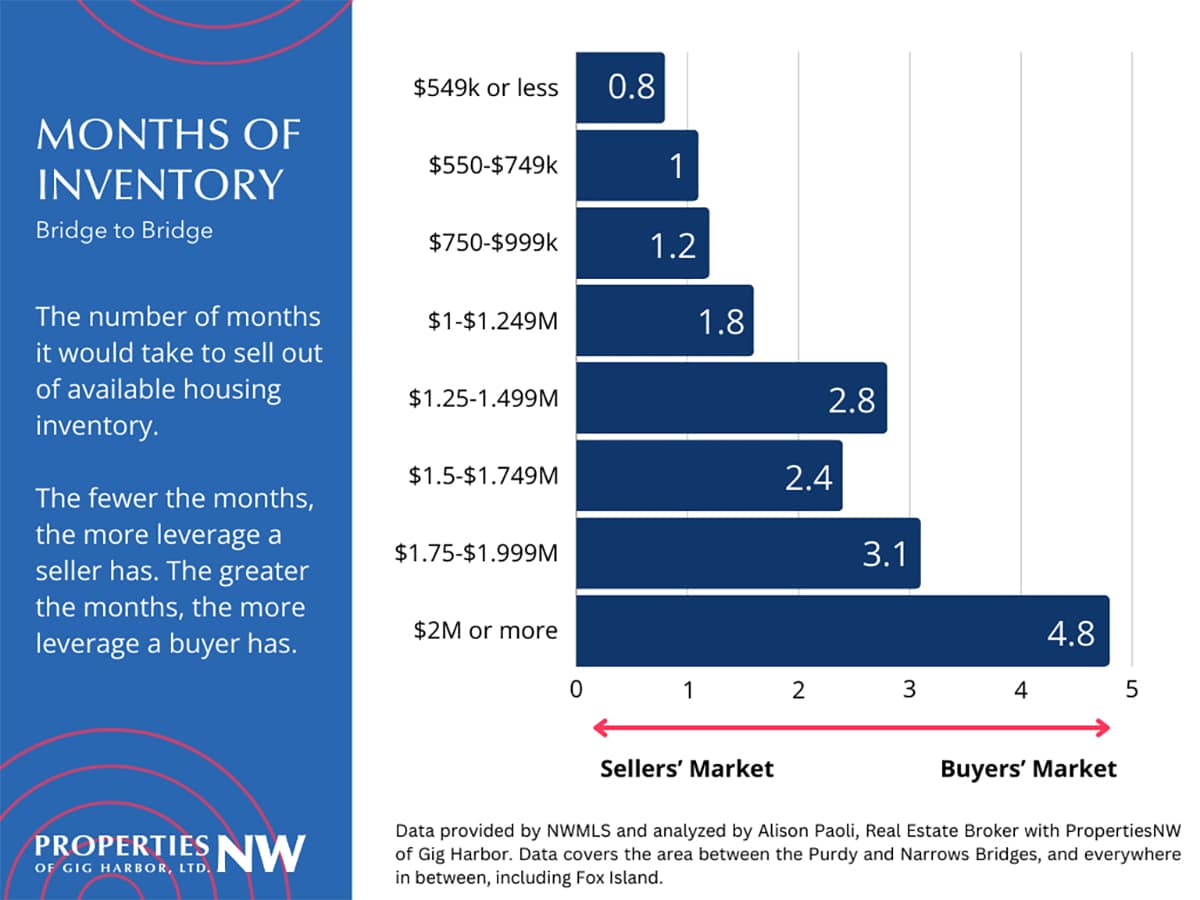

Buyers can also take comfort in a slightly less competitive landscape. Though sellers still have the upper hand in supply and demand, there has been an overall increase in the months of supply — the length of time it would take to sell out of all homes at the current sales pace.

This metric reached 1.7 months in February, up from 1.4 months in January and 1.1 months in February 2023. Nevertheless, it’s imperative that buyers approach this upward trend with measured enthusiasm, given that 2.5 to 3.5 months has historically been a more healthy range for the area and not all price brackets are created equal.

The current supply and demand imbalance is more pronounced in lower price brackets, with only 0.8 months of inventory for homes below $550,000, compared to 2.8 months for those priced between $1.25 and $1.499 million and 4.8 months for homes priced above $2 million (see chart).

While all prospective buyers should be pre-approved for a mortgage before home shopping, buyers with budgets below $1.25 million should be prepared to act fast. This means being willing and able to see homes on short notice in person or on a video call to increase their chances of scooping up their ideal home.

A home on Pioneer Way in Gig Harbor, listed by Patrick Mercado of PropertiesNW of Gig Harbor for $749,000.

What to expect in the coming months

Looking ahead, we should continue to see an uptick in inventory through the summer. The wild card is how long each of those homes is on the market and how competitive the bidding process will be. What we do know for near certainty is that the most appealing homes in any price bracket will continue to go fast, with many of them experiencing bidding wars.

For buyers looking to avoid bidding wars, I recommend viewing homes that have been on the market for 10 or more days. They might not be everyone’s perfect home, but they could be your perfect home, and you may be able to get into it while avoiding the frenzy.