Business Community

Gig Harbor Real Estate | Median single-family home price tops $900,000 in August

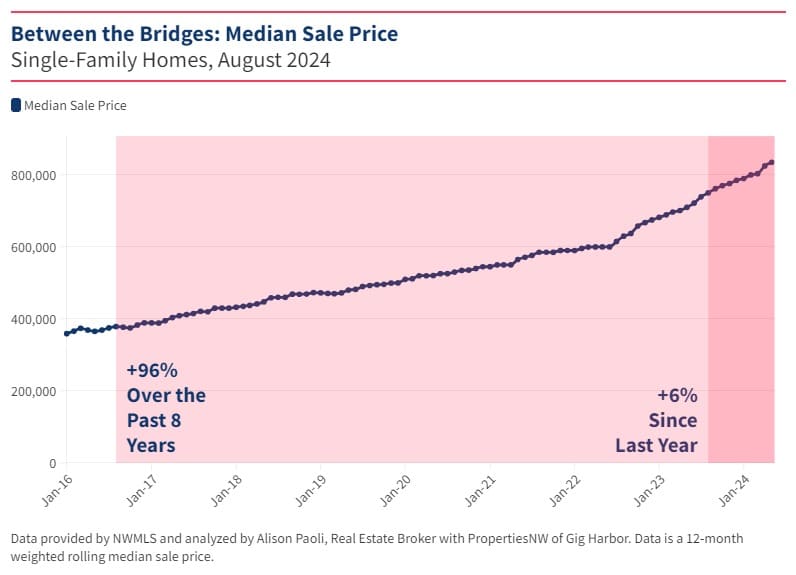

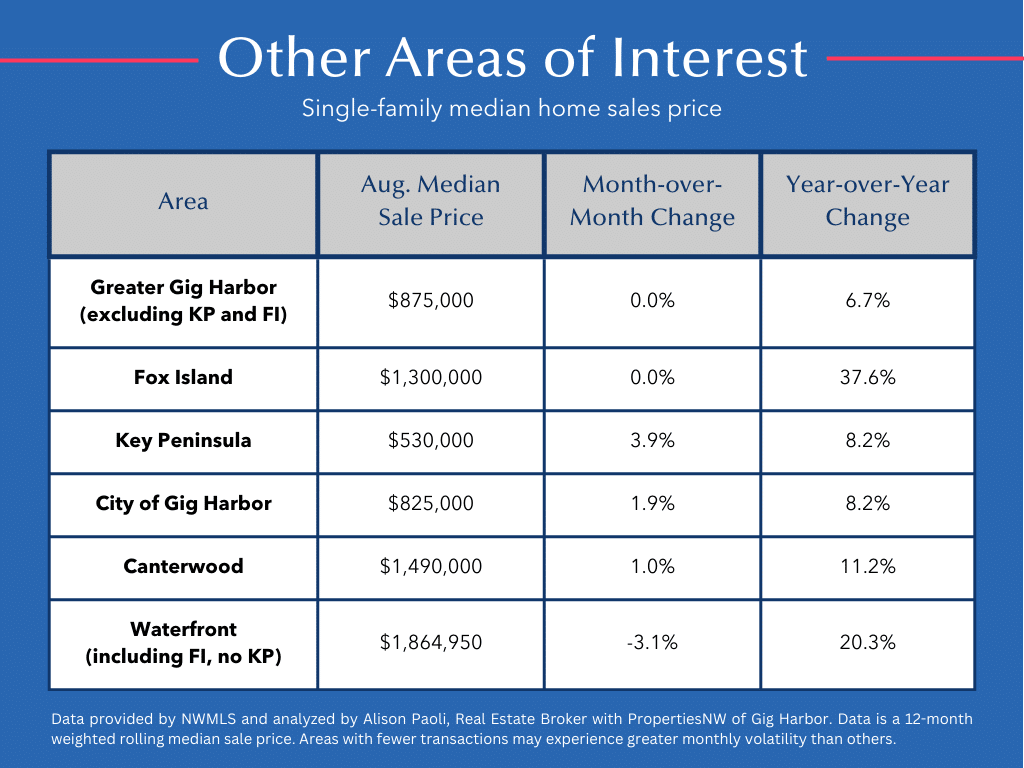

For the 11th straight month, the median price of a single-family home in the greater Gig Harbor between the Purdy and Narrows Bridges, including Fox Island, rose in August — and it hit $900,000 for the first time. The median home price is up 8% since last August and nearly 100% since August 2016, according to data from the NWMLS.

For the second month in a row, the number of new listings of single and condos on the market fell, a common occurrence during the back half of the summer. Homebuyers should expect new inventory to continue to decline each month through December before rising again in January.

But while new listings fell, the total number of homes on the market continued to rise. At the end of August, 167 single-family homes and condos were available to buy, an increase of 5% from July and 51.8% from August 2023, when there were just 110 homes available for sale.

A 50% increase in housing inventory may seem like a big jump in one year, and it is, but it is more of a reflection of the persistently low inventory levels during the COVID-19 pandemic and the following years, than an alarming trend. For context, in August 2019, the last August before the start of the COVID-19 pandemic and a year many economists site as the last “normal” year, 247 single-family homes and condos were available for sale. Today’s levels are 32% lower than they were then.

Supply and demand, or the months of inventory on the market, tells the story of whether rising inventory levels will materially impact the median home price in the area. In the greater Gig Harbor area, with 3.3 months of inventory in August, we are bordering a seller/neutral market. This number historically peaks from July to September and falls through the near year. Assuming that happens this year, it means that the market right now presents the best opportunity for buyers, and the rest of the year will be met with lower inventory and more competition.

A well-maintained Gig Harbor North area home is listed for $740,000 by Patrick Mercado, real estate broker with PropertiesNW.

Mortgage rates hit 52-week low

Recently, the rate of a 30-year fixed mortgage dropped considerably. According to Mortgage News Daily, on the day of reporting, the rate stood at 6.11% (although a client of mine just snagged 5.25% on their purchase!), down from 7.52% at the beginning of the year and from 8.03% on October 19, 2023, when mortgage rates peaked.

Most economists agree that the odds of getting back to 4% or below are very low. But the lower rates, relatively speaking, will eventually help homeowners who are rate-locked — those who have such a great interest rate that it doesn’t make sense to move, even if they want or need to — get into homes that better meet their needs. That may take some time though as according to 3Fourteen Research, mortgage purchase applications have yet to see a meaningful uptick despite the lower rates.

Have a question about the data in this article or how the current real estate market impacts you? Connect with me at [email protected].

Alison Paoli