Business Community

Gig Harbor Real Estate | A shift may be emerging in the local market

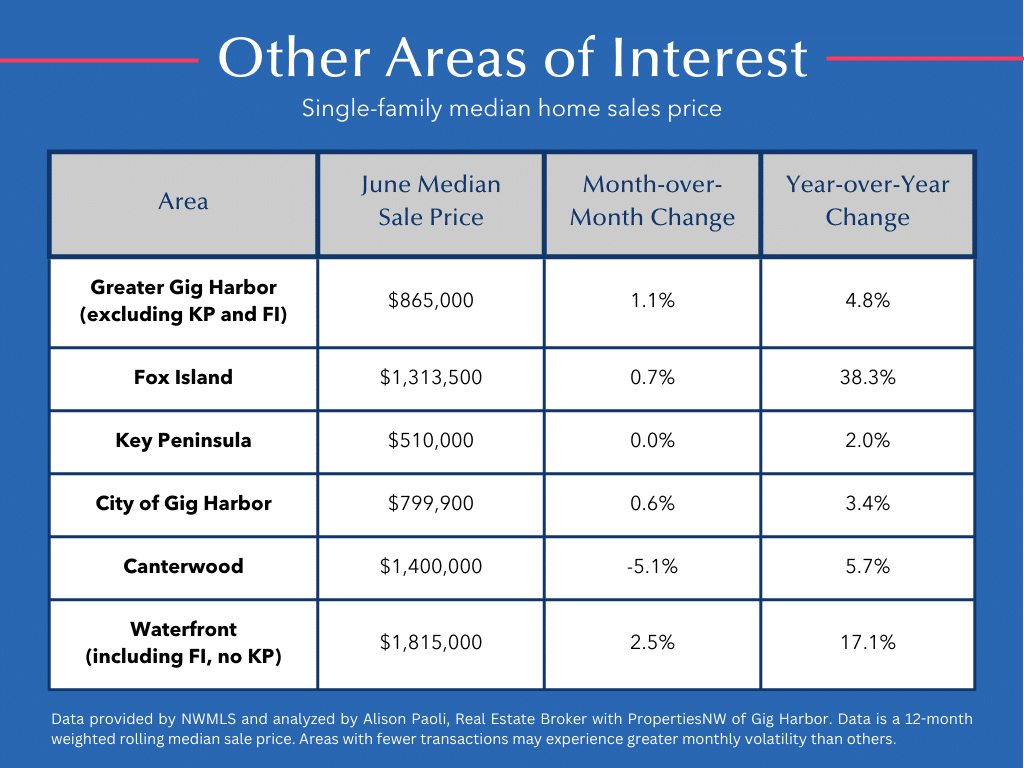

The housing market in Gig Harbor is experiencing steady growth, with the median sale price for single-family homes showing consistent significant monthly increases. According to data from the NWMLS, the median price of a single-family home between the Purdy and Narrows Bridges, including Fox Island, rose 0.8% from May to June. Over the past year, it has climbed by 4.7%, reaching $885,000 in June 2024.

This upward trend is particularly notable given the market’s recovery since September 2023, when the median price was $827,492 — a 6.9% increase. If this trajectory continues, the median home price in the greater Gig Harbor area will exceed $900,000 by September. For historical context, five years ago, in June 2019, the median sale price was $571,363.

Market is changing

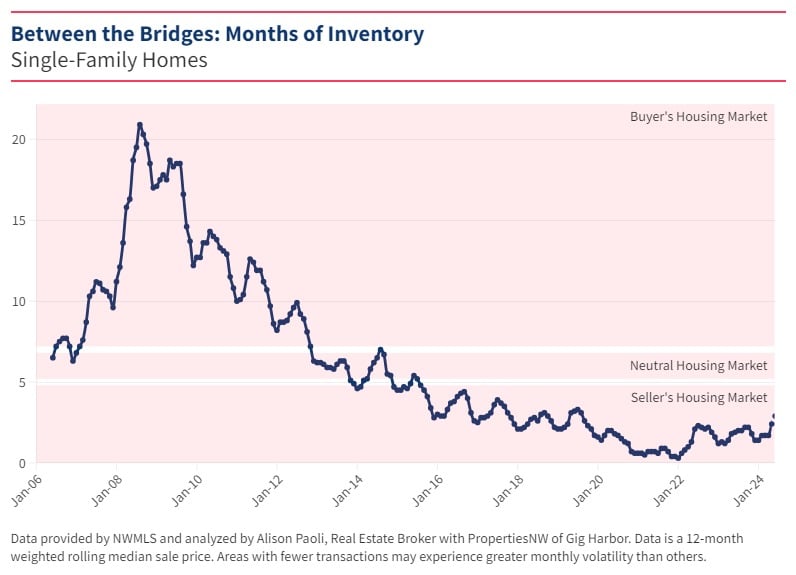

However, the local housing market has changed somewhat in recent months, which may slow the rate of price growth. Months of housing supply, an indicator of supply and demand, have consistently risen since January 2024, with the most significant jump occurring between April and June.

Now, at 2.9 months of inventory, the rate is still well within a seller’s market of 0-4 months. But the closer we are to a neutral market, the less buyer frenzy there is, especially relative to the period of time at the height of COVID-19. For buyers, this generally means more supply to choose from and fewer bidding wars. For sellers, this generally means more time spent on the market and fewer offers with contingencies like waived inspections and financing.

With all that being said, the best homes are still flying off the market, often with multiple offers and waived contingencies. In June, of the 66 homes that went pending between the Purdy and Narrows bridges, including Fox Island, half were on the market for five days or less, while the other half were on for at least six days.

Waiting for the goose

At face value, this pace appears to be more akin to what Gig Harbor experienced during the buying frenzy at the height of COVID. However, by looking at the average number of days on the market, 17, we see that collectively, homes are staying on longer. The homes that don’t fly off the shelves in the first five days are taking longer to sell than they did during COVID. During COVID, the average was closer to 10-14 days.

A home in the Chelsea Park community that experienced a bidding war in June 2024, and was purchased for $1,445,000 with representation by Patrick Mercado of PropertiesNW of Gig Harbor.

What I am seeing on the ground with my clients is a sort of a game of Duck, Duck, Goose. My clients have the opportunity to see more homes than they have in the past few years and are less likely to sacrifice their needs list (the Duck, Duck part of the game). But, when they find their “goose,” they’re off to the races and want to get a strong offer in quickly. It can be a bit of a roller coaster, but by seeing many “ducks,” they know their “goose” when they see it and are ready to go all in.

As we approach the beginning of the school year, the influx of new listings should fall, leading to a contraction in housing inventory. Although home prices in Gig Harbor have been rising steadily, it is possible we will see some price stabilization due to seasonality.

Nonetheless, without a significant increase in inventory, prices are likely to continue their upward trajectory. Considering the Federal Reserve’s strategy to keep interest rates high to temper inflation, mortgage rates are expected to remain around 7%, which could influence buyer affordability and market dynamics.

Have a question about the data in this article or how the current real estate market impacts you? Connect with me at [email protected].

Alison Paoli