Business Community

Gig Harbor Real Estate | Home prices up again, and so is inventory

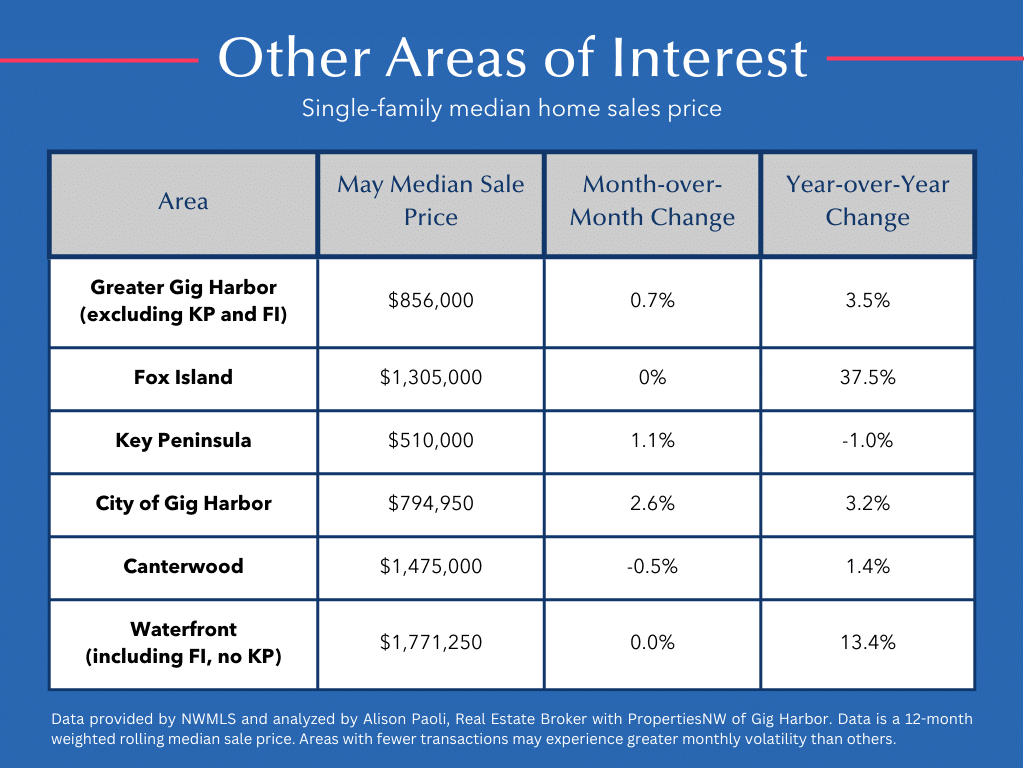

In what seems like clockwork, home prices in the greater Gig Harbor notched up again in May, with inventory making more significant gains. According to data from the NWMLS, the median sale price of a single-family home between the Purdy and Narrows bridges, including Fox Island, rose 0.4% from April to May 2024 to $878,398.

The median home price of a Gig Harbor area home is now up 1.3% since its last peak in October 2022 and up 6.2% since its most recent bottom in September 2023, when it was $827,492.

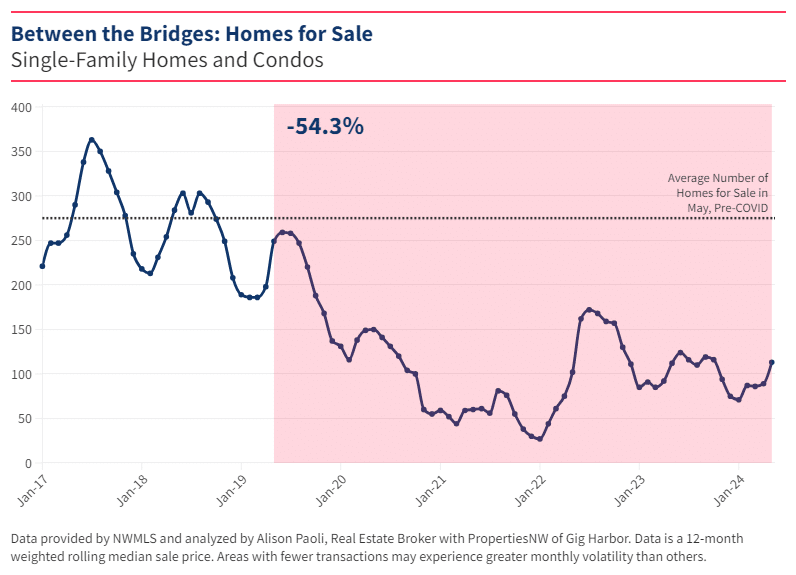

Inventory still below pre-COVID normal

Both housing inventory and new listings took a significant and much-needed jump from April to May, up 25.8% and 39.5%, respectively. However, at just 112 homes for sale at the end of the month, the jump only puts us on par with May 2023 and still well below normal, pre-COVID.

Compared to May 2019, the last pre-COVID May, listings of single-family homes and condos for sale are down 54.3%. If we used the month of May in the three years before the COVID-19 pandemic as a proxy for normal, we are shy 163 listings (-59.3%). The greater Gig Harbor area housing market has a long way to go to get back to normal.

But while we saw a large monthly increase in the number of sellers in the market, buyers did not come to market with the same gusto. The number of pending sales from month to month rose just 7.2% to 68, which is lower than normal for May.

Photo caption: A Raft Island waterfront home with western exposure is listed for $1,525,000 by Kathy Swenson, real estate broker with PropertiesNW.

Months of supply

The ratio of sellers and buyers in the market in May pushed the area’s months of supply — the length of time it would take to sell out of all homes given the current sales rate — to a two-year high of 2.3 months. It is normal for months of supply to rise in the spring and summer, sometimes significantly, before falling again in the fall and hitting its low during the holidays. That said, months of supply do bear watching, as supply in demand is what primarily supports home prices.

For sellers, increased months of supply can mean spending a little more time on the market and the expectation of fewer bidding wars and waived contingencies. Conversely, for buyers, the quick shift in market dynamics can represent opportunity. With less competition often comes less stress, rapid-fire decision making, and the fear of losing out on a home is eased by knowing there are others available.

I say this with one caveat, as I always do: the best homes priced and marketed well will almost always move very quickly, so it is important to act quickly if you find your unicorn.

Don’t expect prices to plummet

But even with the rise of inventory, research tells us that we are far from it being enough to put downward pressure on home prices. Per an analysis from ResiClub, a media and research company that tracks, analyzes, and reports on the U.S. housing market, we would need to see significantly more active housing inventory than we did pre-COVID to see prices fall.

A great example is Austin, Texas, where active inventory is up 35% since May 2019, and prices are down 18.7% since they experienced their peak home prices in 2022. Another example is New Orleans, where inventory is up 9% since May 2019 and home prices are down 13.7% since its 2022 peak.

Have a question about the data in this article or how the current real estate market impacts you? Connect with me at [email protected].

Alison Paoli