Business Community

Gig Harbor Real Estate | Demand remains strong as home prices, new listings rise

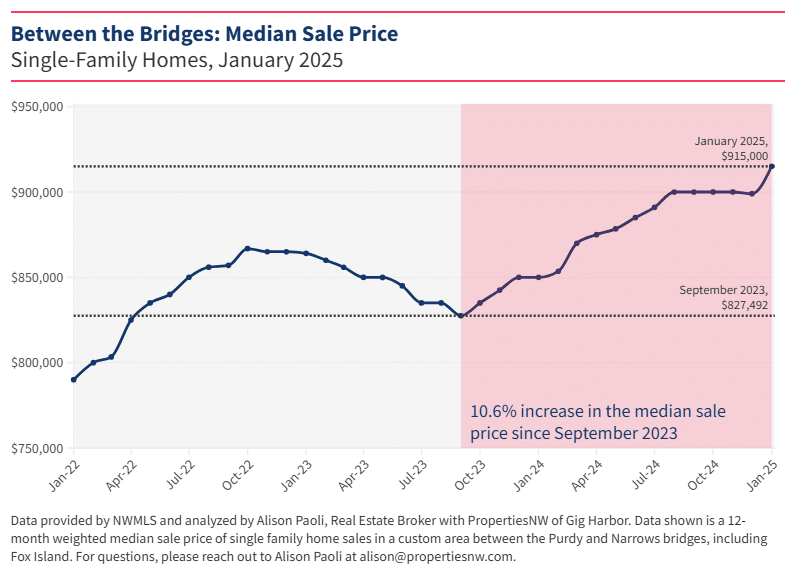

After four consecutive months of flat home prices, the median price for a single-family home in the greater Gig Harbor area — spanning from the Purdy Bridge to the Narrows Bridge and including Fox Island — rose by 1.8% from December to January, reaching a median sale price record of $915,000. This marks a 7.6% increase, or $65,000 gain, compared to January 2024.

However, prices weren’t the only thing on the rise last month. As expected following the holiday slowdown, the greater Gig Harbor market saw a meaningful uptick in new listings. But with that surge came an influx of eager buyers, many of whom snapped up homes as soon as they became available. Despite 2.5 times more new homes hitting the market in January compared to December, the supply-demand imbalance favoring sellers we’ve experienced as of late remains firmly in place.

Listed by Hailee Keely, real estate broker with PropertiesNW, a home sold for full asking price of $899,950 in just four days in January 2025.

A closer look at the data reveals that 63 homes entered the market in January, while 46 went under contract. For sellers, this dynamic challenges the common belief that spring is the optimal time to list. In a market like today’s, the first few months of the year can present an excellent selling opportunity, thanks to pent-up demand from buyers who held off over the holidays and a limited selection of available homes.

January also saw a four-year high in closed sales — transactions that closed in January and likely went under contract in December—further underscoring the strong buyer demand. Additionally, the median days on the market data highlights this increasing demand. In January 2025, homes took a median of 19 days to sell, compared to 39 days in January 2024 and 49 days in January 2023. This downward trend indicates that buyers are moving faster to secure homes, reducing the time properties stay available.

The last time Gig Harbor home prices declined was from late 2022 to mid-2023, a brief period when mortgage rates surged, and many buyers temporarily exited the market. However, once the dust settled, the market returned to significant annual price gains. Those who bought during that dip reluctantly secured homes at a 7% mortgage rate — about the same rate offered today — but have since benefited from a roughly 10% increase in home value.

Given recent trends, those hoping that home prices in Gig Harbor will decline may be disappointed. Current data suggests otherwise. With limited new construction coming on the market and many homeowners holding onto their properties due to ultra-low mortgage rates (often below 3.5%), should the economy remain relatively stable, a meaningful drop in home prices seems unlikely in the near term.

In speaking with buyers, a pattern is slowly beginning to emerge. One recent conversation with a client revealed a shifting mindset: despite having a reluctance to sell due to a low mortgage rate, she is reaching a point where her happiness outweighs financial considerations. She is now willing to trade her larger home for a smaller one with a higher rate and a similar monthly payment because it better fits her needs. As time goes on, we may see more sellers following suit — those who have been “waiting it out” deciding that quality of life is worth the trade-off.

Looking ahead, Gig Harbor’s real estate market will continue to favor sellers, and while inventory has increased, demand remains strong.

Have a question about the data in this article or how the current real estate market impacts you? Connect with me at [email protected]

Alison Paoli