Business Community

Gig Harbor Real Estate | A tale of two markets, single-family homes and condos

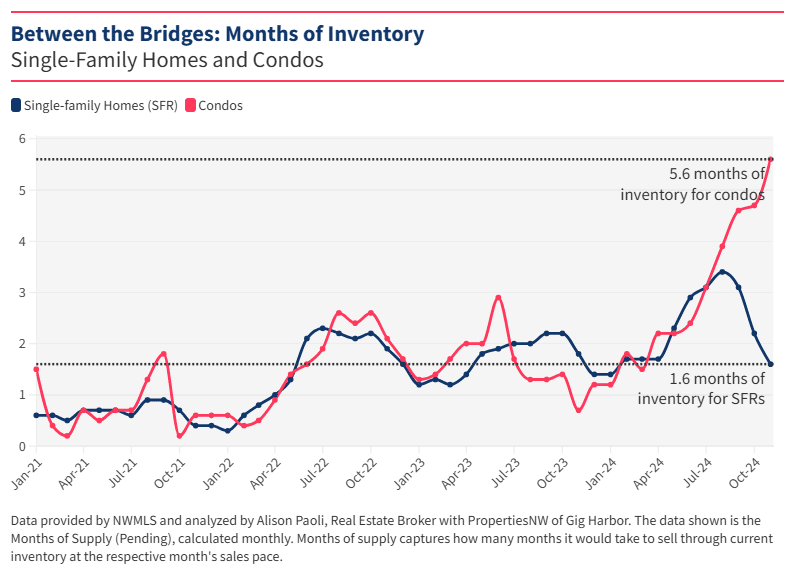

The single-family home market in the greater Gig Harbor area, spanning from the Purdy Bridge to the Narrows Bridge and including Fox Island, remains robust. In contrast, the condo market has cooled significantly in recent months due to an increasing supply of condos and stagnant sales.

As of the end of November, 19 condos were for sale in the area, the highest number since summer 2018. With 5.6 months of inventory — the estimated time it would take to sell all available condos at the current pace — the condo market is nearing a buyer’s market, giving buyers the advantage. This marks the highest level of supply since early 2015.

Meanwhile, demand for single-family homes continues to rise, outpacing the number of homes available for sale. With just 1.6 months of supply, buyers face limited options, and homes with broad appeal are frequently selling within a weekend or less.

Despite this high demand, the median price for single-family homes has remained steady at $900,000 for the past three months. If demand continues to exceed supply at this rate, prices could increase in the coming months, particularly as January — a period of increased buyer interest but limited seller activity — approaches.

What’s ahead in 2025

Looking ahead, many economists predict national home prices will rise by 2 to 4% in 2025, with mortgage rates stabilizing around 6%. In Gig Harbor, where median home prices have consistently outpaced national growth — often doubling it — local trends suggest this trajectory will likely continue.

However, not all markets are seeing similar growth. In some parts of the U.S., home prices are falling due to higher inventory levels. For example, Austin, Texas, experienced a surge in demand during the COVID-19 pandemic but now faces price declines due to oversupply. Housing inventory in Austin is up 42% compared to November 2019, and home prices have dropped 10% since peaking in the second quarter of 2022, according to Realtor.com.

A Henderson Bay waterfront home with two tax parcels and 100 feet of waterfront is listed for $1,395,000 by real estate broker Neil Bender of PropertiesNW of Gig Harbor.

In contrast, the greater Gig Harbor area has seen its housing inventory decrease by 40% compared to November 2019 and the median home price has risen by 7% since Q2 2022, demonstrating resilience against elevated mortgage rates.

Whether Gig Harbor can maintain its growth and avoid the fate of cities like Austin and many parts of the South remains to be seen. However, oversupply is unlikely to become an issue here, as limited opportunities for new home construction prevent an excess of housing, and skyrocketing homeowners insurance rates — often forcing people to move — are less pronounced in this market. With constrained inventory and sustained demand, home prices are expected to continue rising, even amidst the higher interest rates of recent years.

Have a question about the data in this article or how the current real estate market impacts you? Connect with me at [email protected]