Business Community

Gig Harbor Real Estate | Housing activity picking up steam as spring begins

While home prices remained flat from January to February, home sales saw a significant uptick, potentially foreshadowing a busy spring and summer selling season in the greater Gig Harbor area — spanning from the Purdy Bridge to the Narrows Bridge and including Fox Island.

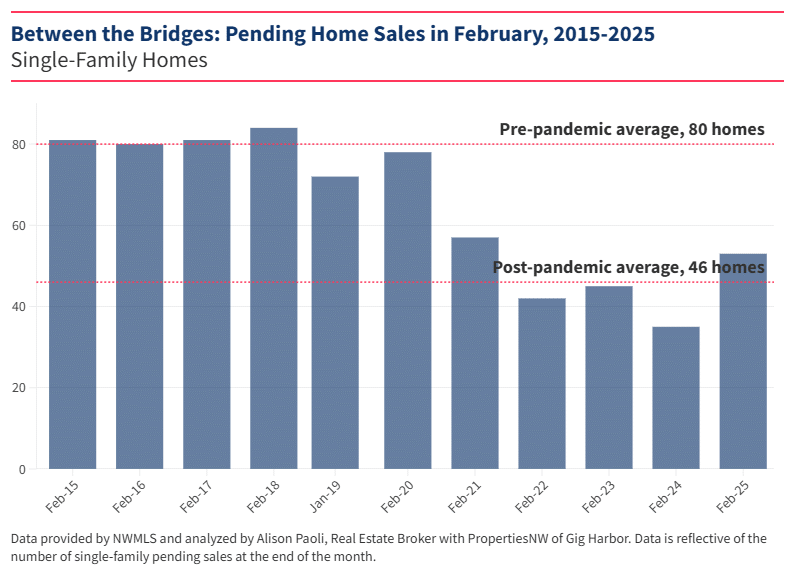

Pending sales of single-family homes in February — homes that have gone under contract but have not yet closed — were up 40%, from 39 in January to 53 in February. Year over year, pending sales saw an even greater increase of 51%, rising from 35 homes under contract in February 2024.

Pending sales and housing supply

February pending sales reflect what we have been seeing in the real estate market post-pandemic compared to prior to the COVID-19 lockdown. Between 2015 and 2020, the average number of February pending sales was 80 homes. Since the pandemic, that average has dropped by 42.5% to 46 homes, with a low of 35 pending sales in February 2024.

While pending sales are a strong indicator of market activity, they are just one piece of the broader real estate landscape. Housing supply, measured by total homes for sale and new listings, has remained relatively flat. There were 78 single-family homes for sale in February 2025, the same as in February 2024. New listings have increased slightly, up 1.7% from January and 13.5% year over year.

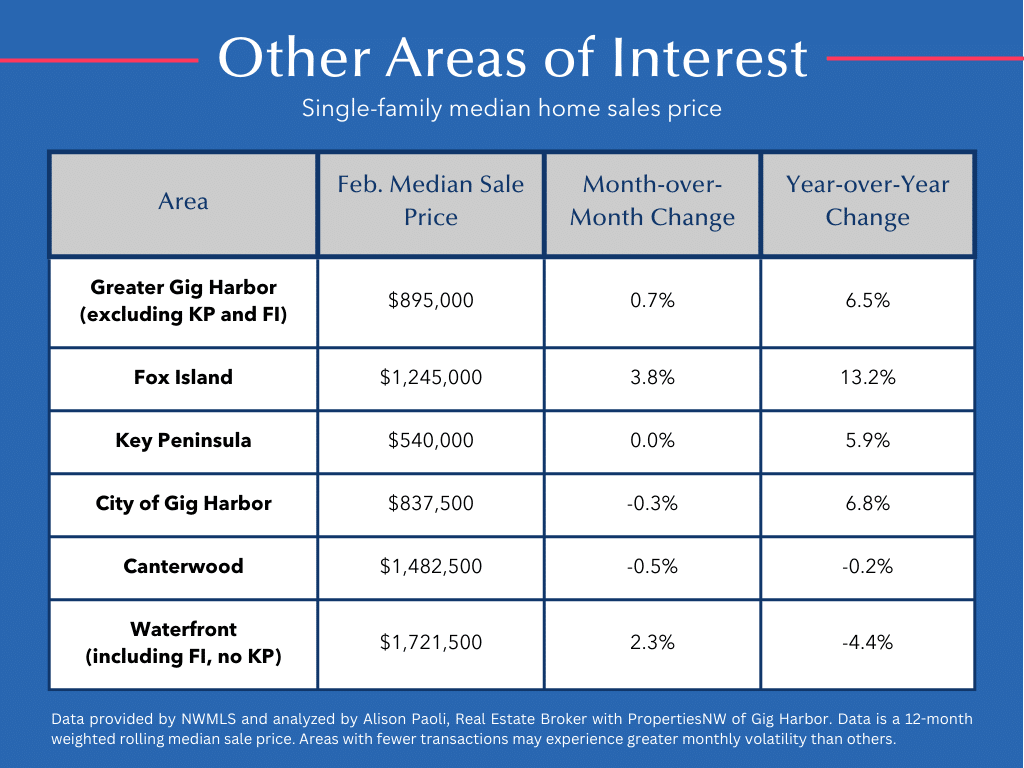

At $915,000, the median home price in the greater Gig Harbor area remained unchanged from January to February but is up 7.6% from $850,000 in February 2024, outpacing the national average as reported by Zillow, the Case-Shiller Index, and other major sources.

Mortgage rates and other wild cards

Looking ahead, the market’s momentum is being fueled by rising pending sales, a persistent supply-demand imbalance that continues to favor sellers, and home prices that remain on an upward trend. However, broader economic conditions could influence future activity.

Mortgage rates have eased slightly in recent weeks, but many buyers are still watching for further declines. Trade policies and tariffs may impact construction costs, though their long-term effect remains uncertain. Additionally, fluctuations in tech stocks — a common source of down payment funds in the Pacific Northwest — have introduced some financial unpredictability.

While Washington’s unemployment rate has stayed stable, recent layoffs at major companies have raised some concerns. Ultimately, the market’s trajectory will depend on how these factors unfold, but for now, real estate in the greater Gig Harbor area remains strong.

Have a question about the data in this article or how the current real estate market impacts you? Connect with me at alison@propertiesnw.com.

A historic waterfront Austin & Erickson vertical log home on Henderson Bay with views of the Olympic Mountains is listed for $824,500 by Neil Bender, real estate broker with PropertiesNW.

Alison Paoli