Business Community

Gig Harbor Real Estate | Looking back at ’24, thinking ahead to ’25

Despite a challenging economic backdrop of elevated interest rates and reduced real estate activity, the greater Gig Harbor housing market demonstrated remarkable resilience in 2024.

Spanning from the Purdy Bridge to the Narrows Bridge, including Fox Island, the median home price for single-family homes continued its steady climb, signaling that demand remains strong despite headwinds. To put this growth into context and to understand what it may mean for the future, let’s take a look at some key indicators for the health of the real estate market as we close out the year.

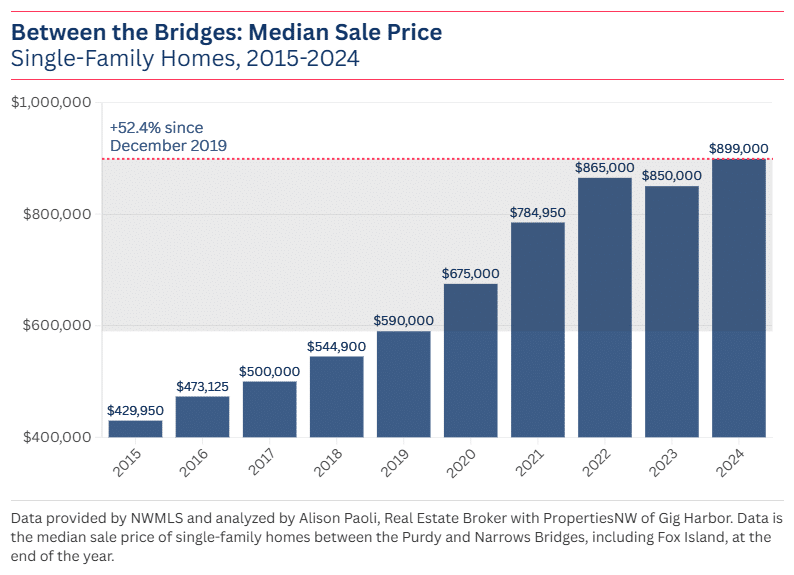

Single-family home prices: Steady growth

The COVID-19 pandemic marked a period of incredible growth in home prices, with year-over-year increases nearing 20% at times. However, the rapid rise in mortgage rates in 2022 slowed this growth.

After home prices stabilized in 2023, they are climbing once more, increasing by 5.8% since December 2023 and surpassing the previous annual peak of 2022 by 4%. Of note, the median home price in the greater Gig Harbor area has risen by an impressive 52.4% since December 2019, the last “normal” month before the pandemic reshaped the housing market.

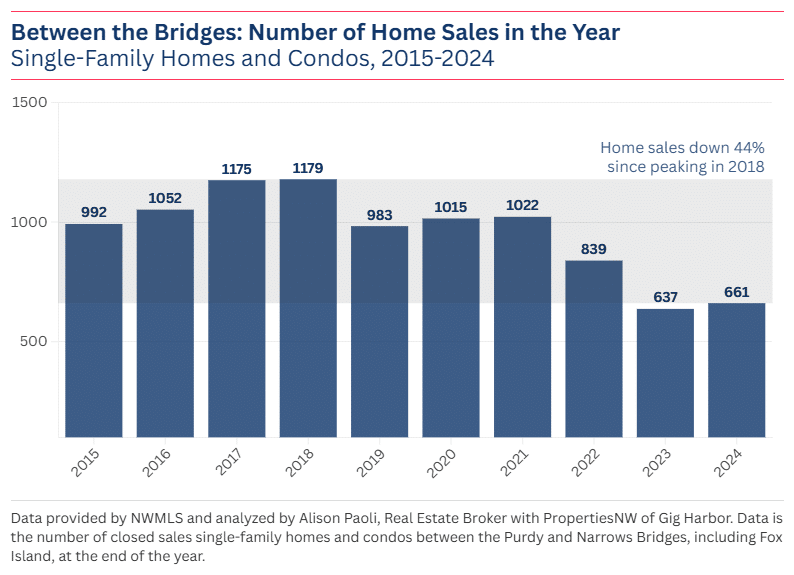

Home sales: A market in flux

For the third consecutive year, home sales in the greater Gig Harbor area remained below average, largely due to higher mortgage rates. Many homeowners are holding on to their favorable interest rates — often referred to as “golden handcuffs” — and are reluctant to sell and assume higher rates.

A study by the Federal Housing Finance Agency (FHFA) found that homeowners are 18.1% less likely to sell their homes for every percentage point increase in mortgage rates compared to the rate they secured when purchasing their property. While this effect will diminish over time, the sales volume is unlikely to recover significantly unless rates drop to the mid-5% range or lower.

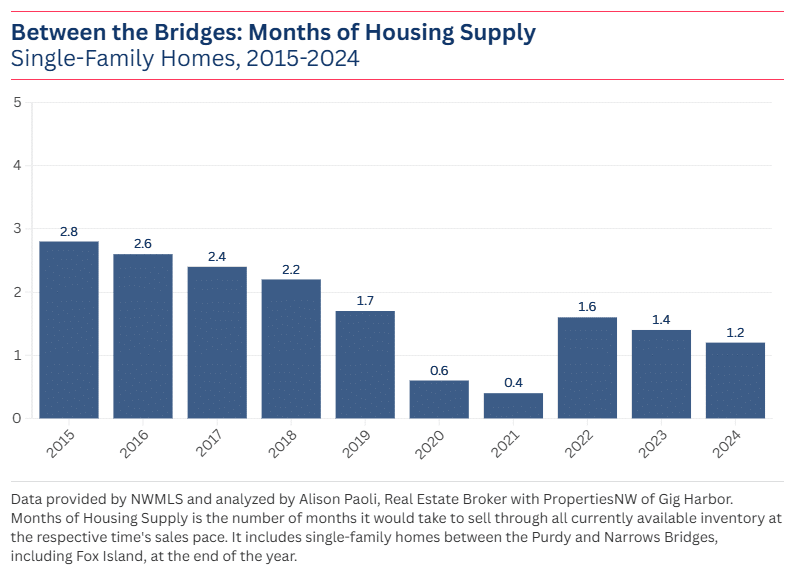

Supply and demand: A seller’s market

The balance of supply and demand continues to favor sellers, with inventory levels remaining critically low. Housing supply, measured in months, dropped to 1.2 months by December 2024. The fewer the months, the more competitive conditions we see, which can include multiple offers, reduced contingencies, and rising home prices.

To prevent or slow home price increases, there would need to be a significant shift in market dynamics. This could happen through a meaningful decrease in the number of buyers or a rapid increase in housing supply. A reduction in buyers might occur if mortgage rates rise sharply again or if the economy experiences a downturn leading to widespread job uncertainty. On the other hand, supply could increase through new construction efforts or, more dramatically, if an economic downturn leads to job losses and forced sales.

While no one scenario seems imminent, and new construction as the pathway out seeming the the least likely, these potential scenarios underline the delicate balance of the market and how shifts in economic conditions, buyer sentiment, or construction trends could influence the trajectory of home prices in the greater Gig Harbor area.

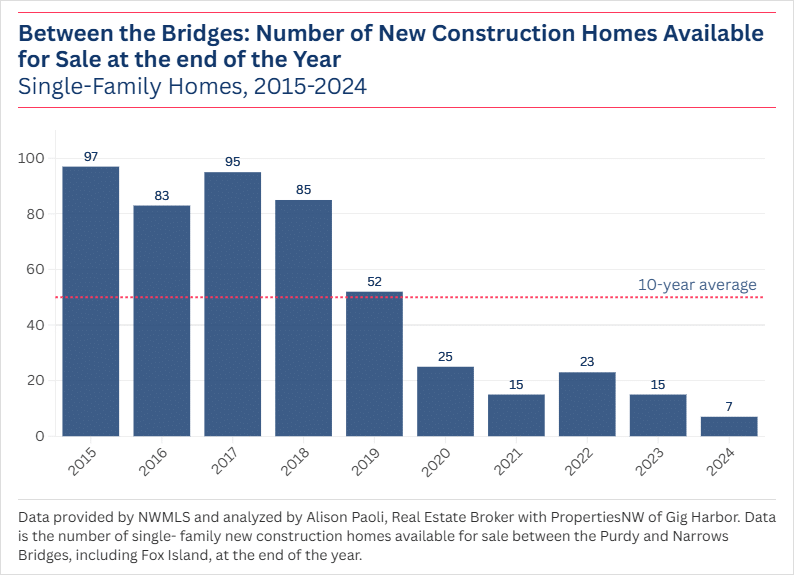

New construction: A decline in inventory

Over the past decade, the greater Gig Harbor area has experienced significant expansion, with some large new construction developments in Gig Harbor North, along Skansie Avenue, and scattered throughout other pockets of the community. However, this wave of growth slowed dramatically in recent years, with new projects now limited to only a few smaller neighborhoods.

By the end of 2024, at just 7 homes, the Gig Harbor area recorded its lowest number of new construction homes on the market at the end of the year since 2012. This sharp decline in new construction inventory has further tightened the already constrained housing supply, intensifying competition among buyers and contributing to continued upward pressure on home prices.

A look ahead to 2025

As Gig Harbor enters 2025, the real estate market remains at a crossroads. The factors driving price growth — limited supply, strong demand, and the “golden handcuffs” effect tying homeowners to their low-interest mortgages — show no signs of changing.

Economists are divided on what lies ahead. Some predict modest price growth and a gradual recovery in sales, while others foresee a potential boom fueled by easing interest rates or shifts in economic policy. With the transition to a new presidential administration, uncertainty looms, as potential policy changes could reshape the market in unforeseen ways.

A move-in-ready rambler in Point Richmond bought with Carly Bloecher, real estate broker with PropertiesNW of Gig Harbor.

Despite the speculation, one principle remains steadfast: the fundamentals of supply and demand. As long as inventory stays tight and buyer interest remains strong, the greater Gig Harbor housing market is likely to retain its resilience, continuing to adapt to the broader economic landscape in 2025 and beyond.

Have a question about the data in this article or how the current real estate market impacts you? Connect with me at [email protected]

Alison Paoli