Business Community

Gig Harbor Real Estate | Prices break records … again

Plagued by low inventory and ample demand, the median home price in the greater Gig Harbor real estate market continued to climb in April.

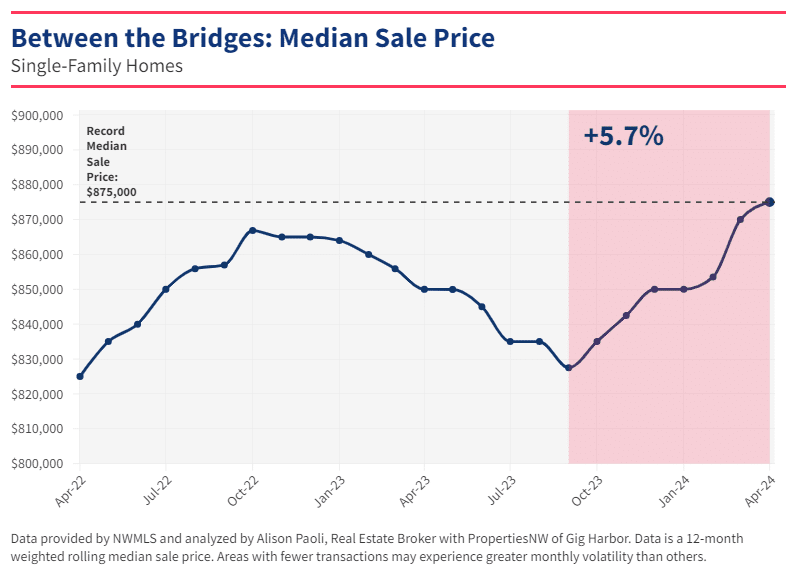

Median home prices hit a new record of $875,000 for a single-family home between the Purdy and Narrows bridges, including Fox Island, according to data from the NWMLS. The figure for a single-family is up $25,000 since the first of the year and nearly $50,000 (+5.7%) since the median price bottomed out in September 2023, following the significant mortgage rate spike that saw the 30-year fixed interest rate jump to nearly 8%.

Altos Research reports that in many parts of the country, particularly in the South, both new listings and inventory have increased — rises of 20% and 33%, respectively. However, this trend barely shows up in the greater Gig Harbor area.

In April, the number of new listings for single-family homes was only 4% higher than a year ago. While any increase in listings is typically seen as advantageous for buyers, it’s important to note that in this context, a 4% increase translates to just three additional homes.

To provide further perspective, our area saw significantly fewer listings in April 2024 compared to April 2019 (before the onset of the COVID-19 pandemic) — specifically, a 45.4% decrease, equivalent to 59 fewer new listings.

Unusual April

In real estate, few things are as predictable as inventory rising in April. This year is an exception.

New construction home in Canterwood offered at $2,895,000 by Neil Bender of PropertiesNW.

Over the past 10 years, inventory counts rose, on average, by 10 percent from March to April. However, this April, inventory fell by 2.5 percent from March. Compared to a year ago, the inventory of single-family homes for sale is up 13 percent, yet it is down nearly 58.2 percent from April 2019.

Despite historically low inventory and new listings, robust buyer demand is exerting upward pressure on pricing. Pending sales in the greater Gig Harbor area in April increased 23.1% from March and 16.4% from one year ago. At the current rate of supply and demand, it would take 1.7 months to sell through all available inventory of single-family homes, down from 1.8 months in March.

Homes on the market in April sold quickly, especially those priced under $750,000. Overall, the median time on the market was 11 days. But for homes under $750,000, it was just six days. Homes priced at or above $1 million took a few days longer, with the highest-priced homes spending a median of 30+ days on the market.

Buyers be ready

However, it’s essential not to let the numbers make you think it’s safe to wait a few days to see a home you love. My last two listings both went pending in the first weekend and sold for well over the asking price, despite being competitively priced from the start. Well-marketed and priced homes will sell fast in this market, so be prepared to tour them as soon as they hit the market, or risk losing out.

If April’s data teaches us anything about the future, it’s to expect continued low inventory, prime homes flying off the market in just a few days, and increasing prices. As for mortgage rates, experts collectively agree that they will remain elevated until inflation falls further and the job market shows prolonged weakening.

Have a question about the data in this article or how the current real estate market impacts you? Connect with me at [email protected].

Alison Paoli