Business Community

Gig Harbor Real Estate | Home prices hit a new record

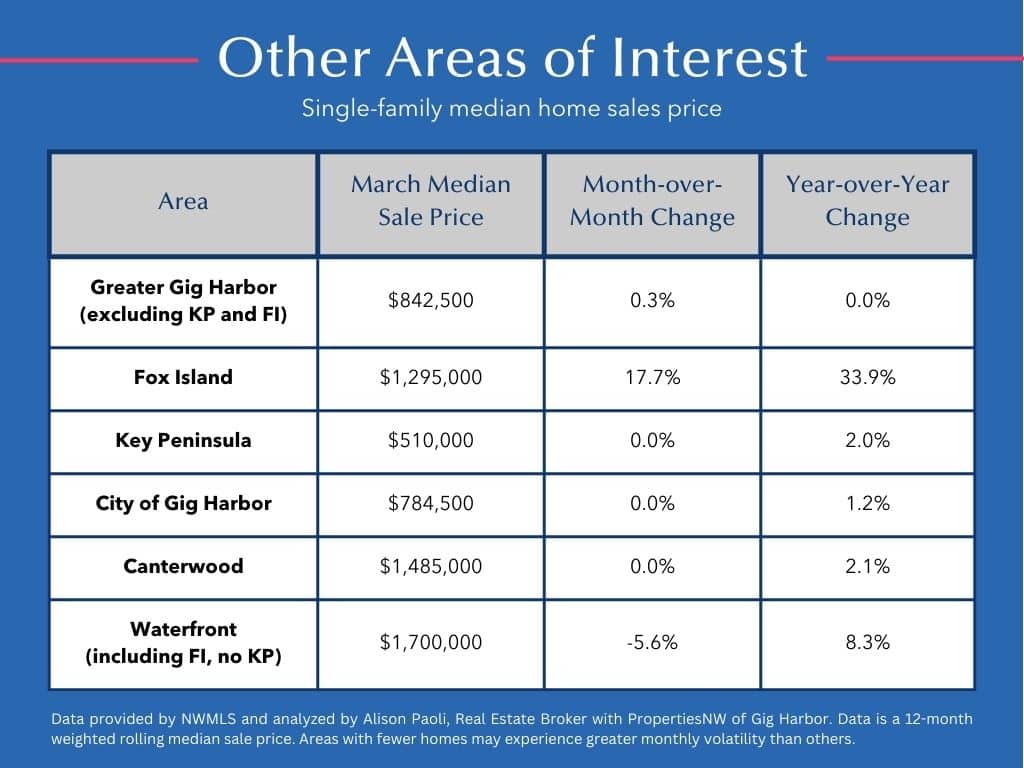

The Gig Harbor real estate market was hot in March, marked by significant milestones and notable trends. According to data from the NWMLS, the median sale price of a single-family home between the Purdy and Narrows Bridges, including Fox Island, soared to a record high of $870,000 in March, underscoring the continued resilience of the local housing market in the face of higher mortgage interest rates. The previous high was $866,835, set in October 2022.

A Rosedale-area rambler on 1.5+ acres is listed for $669,000 by Shavon Rodriguez, real estate broker with PropertiesNW.

From February to March, the median sale price increased by nearly 2%, the most substantial monthly increase since April 2022. Over the past six months, the median sale price for a single-family home has risen 5.1%. The increase can largely be attributed to the rate of demand coupled with the historically low levels of available homes to buy, and it is not likely to change for some time.

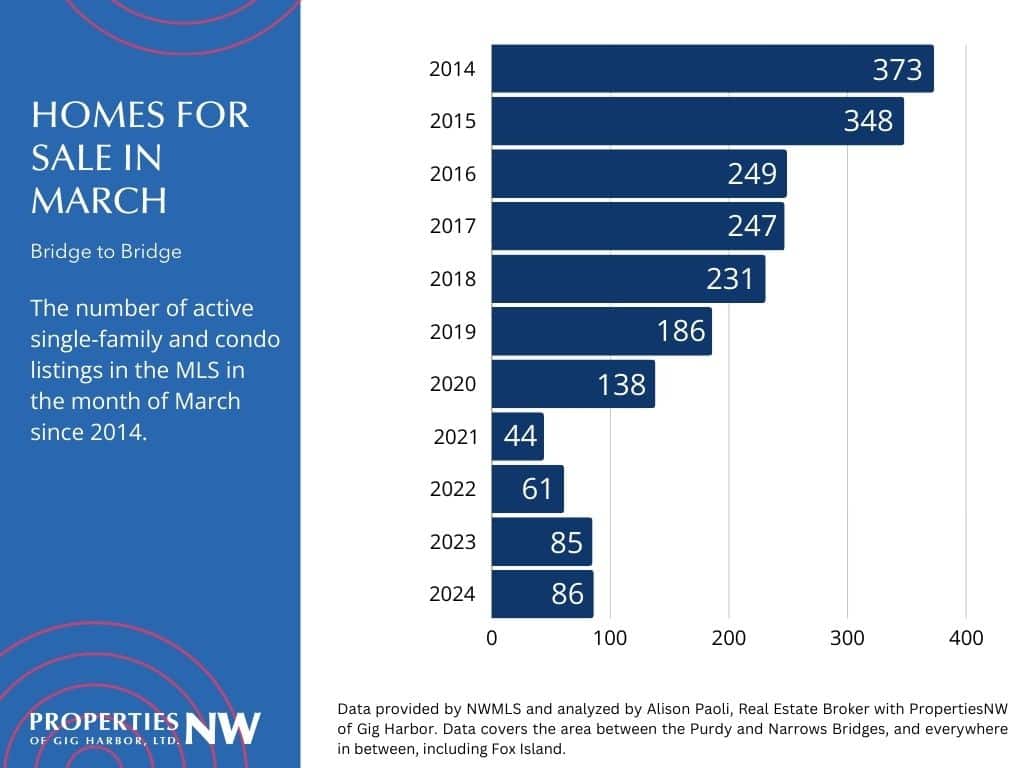

Inventory remains very low

In fact, while we have seen some improvement since the COVID years, only 86 single-family homes and condos were available to purchase between the bridges in March, a significant decrease from pre-COVID years. Having so few options can be a benefit to sellers, but it makes buying more challenging as there is less inventory to select from and more competition for the best homes in each price bracket.

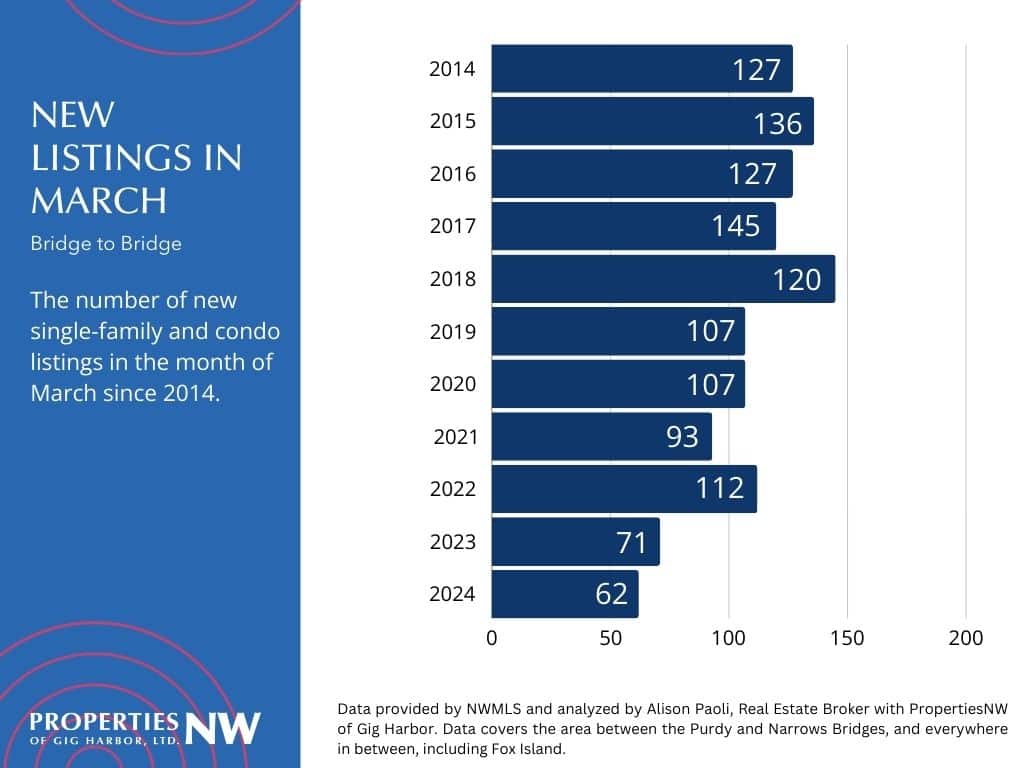

New listings are also down by a wide margin, which is concerning given that March is typically an inflection point where we see a significant jump in new listings, foreshadowing what to expect over the spring and summer selling season.

Typically, the greater Gig Harbor and Fox Island communities witness a 35% surge in new listings from February to March. However, this year, the increase was a mere 1.6%, a stark contrast to the norm. This low increase in new listings could impact the market dynamics in the coming months, making it even harder to be a buyer.

Will home prices continue to rise?

As long as we have historically low inventory, we will likely experience upward pressure on pricing. Elevated mortgage rates are still keeping many would-be buyers on the sidelines. However, plenty of buyers are still paying cash for their homes, have modified their home requirements to something within their budget, or have moved past “mortgage rate shock” into acceptance and are biting the bullet before prices rise. People need homes, and Gig Harbor is in high demand.

For home price growth to slow or trend backward, we need either inventory to pick up or demand to drop off. One way to increase inventory is to add more new construction homes to the mix, which is unlikely to happen soon. In fact, just seven new construction homes were available for sale in the greater Gig Harbor area, tied for the lowest of any month since early 2013.

Another way to increase inventory is for mortgaged homeowners to sell but getting them to do so will not come easy. According to a 2024 analysis, more than half (59.4%) of homeowners have an interest rate below four percent, while 22.6 of mortgage homeowners have an interest rate below three percent. This is the most common peril I hear when talking to buyers I work with — they just don’t want to give up their interest rate.

What if rates fall?

Looking ahead, what concerns me most about the local housing market is what may happen if interest rates fall below 5.5 percent. If that happens, I think we’ll see a significant influx of sidelined buyers, many of whom are not current homeowners, hop into the market. This should increase competition and push prices up, frustrating buyers and potentially making it less affordable to buy than it is today.

Have a question about the data in this article or how the current real estate market impacts you? Connect with me at [email protected].