Business Community

Gig Harbor Real Estate: Prices jump as inventory dwindles, mortgage rates fall

Buying the perfect home in Gig Harbor just got harder and more expensive. The median home price for a single-family home between the Purdy and Narrows bridges, including Fox Island, rose 1.2% in November to $845,000 from $835,000 in October, according to data from the NWMLS. The rise in prices is due, in part, to low inventory and the rapid decline of mortgage rates over the month.

Inventory between the bridges is historically low. In the five years leading up to the COVID-19 pandemic, we had an average of 252 homes for sale in November. This November, we had just 89 single-family homes and condos for sale. Outside of the pandemic years of 2020-2021, until now we had never experienced a November with fewer than 100 homes available for sale.

Fueling the total number of homes for sale is new listings. While November is traditionally a month where we see a limited number of homes come on the market, at just 24 new listings of single-family homes, this month marks the fewest homes we’ve seen come on the market in any month, ever.

A home for sale on Warren Drive. Photo courtesy of Neil Bender of PropertiesNW

Mortgage rate drop brings buyers back to the table

November also brought the first significant decline in mortgage rates with the average 30-year fixed mortgage rate dropping from nearly 8% to closer to 7% over just a few weeks. According to the Mortgage Bankers Association (MBA), the drop in rates was enough to push mortgage purchase applications to a two-month high.

On the ground, this manifests into would-be buyers getting off the sidelines and back into the market, increasing demand for the few homes available.

With supply dwindling and demand increasing, the number of months of inventory is dropping. At the end of November, there was 1.6 months of inventory of single-family homes and condos compared to 2.1 months at the end of October. Months of inventory measures how long it would take to sell out of all available homes with the current sales pace. The lower the number, the harder it generally is for buyers.

The available inventory of new-construction homes is the tightest of all segments of the single-family market. At just seven new homes for sale between the bridges — of which only four are move-in ready — there is only one month of inventory of new homes. Just once in the past 10 years have we seen so few new homes for sale, and that was during the height of COVID-19 when building materials and labor were hard to come by. New construction has been a popular choice for those with mortgage rate shock, since many builders are giving incentives to temporarily buy down mortgage rates, giving buyers a lower monthly payment for two years.

The outlook

As we head through the winter months, I expect the lack of inventory to continue to plague the greater Gig Harbor area. If history repeats, housing inventory in our area will continue to fall over the next few months before picking back up in February or March.

If low inventory persists and at the same time mortgage interest rates stay steady around 7 percent or continue to fall, I expect that demand will meaningfully outpace supply by early next year which will lead a broader return of bidding wars, especially for well-priced homes under $1 million.

Given the market dynamics, what I tell my clients is to continue to stay engaged with the market. Ignoring the market now and waiting until when or if mortgage rates fall further may mean that instead of a slightly higher monthly payment today, they may have to bring more cash to the table in order to be competitive among all of the other buyers who also chose to wait.

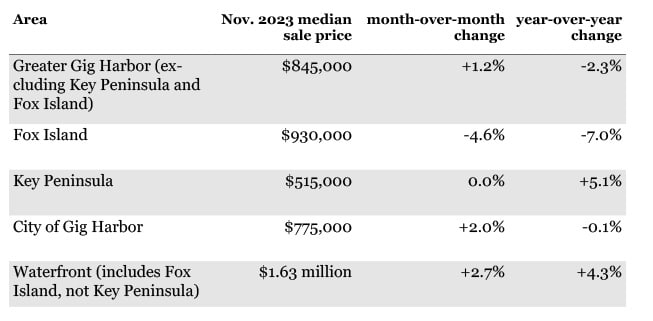

Other areas of interest: Median sale price of single-family homes