Business Community

Gig Harbor Real Estate: Elevated mortgage rates disproportionately impact luxury homes

Home prices for single-family homes in the greater Gig Harbor area fell in September, down 0.9 percent to $827,492, as housing affordability hit its worst month since the start of the century. The decline was curbed slightly by rising prices for new construction, which grew 0.8 percent in September. Home prices for all single-family homes are down 4.5 percent since October 2022 at $866,835 and down 3.4 percent since last September, according to data from the Northwest MLS.

Despite the decline in the median sale price, we are still seeing competition and price escalations for highly desirable and well-priced homes due to historically low inventory.

Opportunities for buyers of luxury homes

The impact of rising mortgage rates is being felt throughout the real estate market. It is impacting Gig Harbor luxury homes to a greater extent as home buyers’ budgets tighten, leaving luxury homes on the market longer and creating opportunities for well-qualified buyers to shop around and negotiate.

One year ago, Gig Harbor single-family luxury homes between the Purdy and Narrows bridges priced at $1.5 million or above made up 20.5 percent of the available inventory. Today, they make up more than one-third of the total housing inventory. At a median of 27 days on the market, they lingered on the market in September more than any other price bracket.

The increased inventory has pushed the months of supply of single-family luxury homes to 6.2 months, making it the only buyer’s market segment in Gig Harbor by traditional measure. All other price brackets are still well within sellers’ market parameters, or neutral. This trend looks to continue as luxury homes made up 25.9 percent of all new listings in September compared to just 13.6 percent one year ago.

It’s a buyer’s market for luxury homes in Gig Harbor. This home listed by Neil Bender of PropertiesNW.

While there may be opportunities for buyers in the luxury market, homes priced below $1 million, especially those priced between $400,000 and $700,000, continue to be in limited supply and move faster off the market. In fact, in September, only 13 single-family homes were available between $400,000 and $700,000, and they only lasted a median of seven days on the market. Looking at the pipeline of new listings in this price bracket, this trend looks to continue, as there were 41 percent fewer new listings in September than there have been over the past five years on average.

New construction inventory dwindling

The number of new construction homes available for sale from the Purdy Bridge to the Narrows Bridge, including Fox Island, is down quite dramatically from one year ago, with many large new neighborhoods selling out of inventory. Only 11 new construction homes were for sale as of the end of September, although only a small portion of those are move-in ready. One year ago, 32 new construction homes were for sale, a decline of 65.6 percent year-over-year. Excluding the year following the start of the COVID-19 pandemic, when construction was effectively halted for a prolonged period, this marks the fewest number of new construction homes on the market since mid-2013.

Many buyers flocked to new construction over the past year because some of the large homebuilders were offering financing incentives that effectively lowered their interest rate for a few years. With fewer new construction options on the table, home buyers should talk to their real estate broker and lender about other ways to lower their interest rate on non-new construction through seller-paid rate buy-downs or even taking over an assumable loan, if available and qualified. Buyers could get the same deal, or better, than what was being offered by major home builders.

Other areas of interest

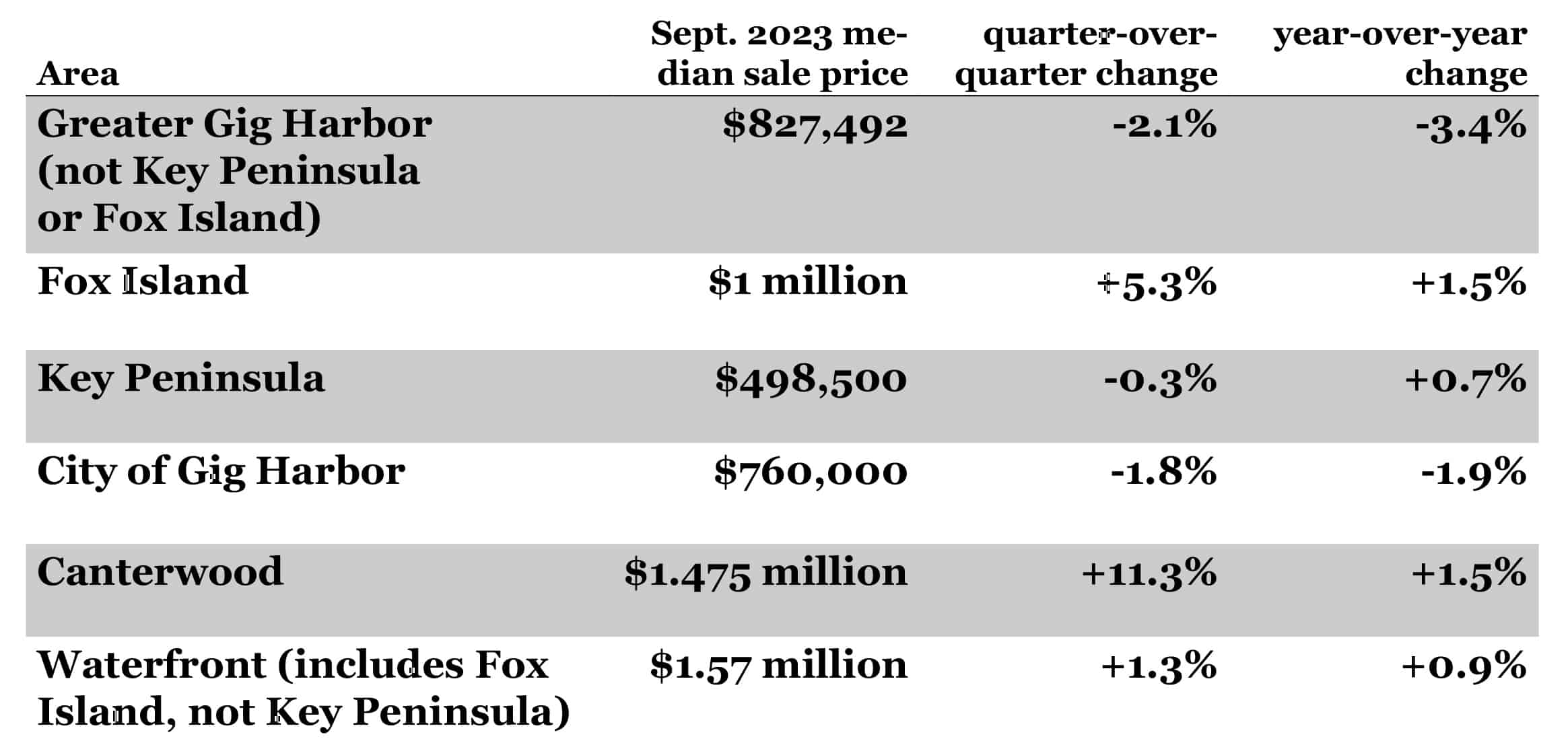

Median sale price, single-family homes: